Twin Cities Builds Credit is a city-wide initiative designed to help more residents become financially empowered by expanding access to credit-building education, resources, and tools—right where people already turn for support: schools, community centers, libraries, health clinics, and local nonprofits.

We’re not just a program. We’re a network.

Our goal is to connect organizations, share best practices, and create a coordinated approach to advancing financial wellness across the Twin Cities.

Leading and Sustaining Credit Building in the Twin Cities

Neighborhood Development Alliance (NeDA) is the lead agency for Minnesota’s city-wide credit-building initiative, bringing decades of experience in financial coaching, homeownership, and equitable wealth-building. For nearly 40 years, we have empowered families of color and historically underserved communities through personalized, HUD-certified financial counseling, credit coaching, and sustainable homeownership programs.

In 2025 alone, NeDA provided financial coaching to 435 participants, helped 120 previously unscored individuals establish credit histories, and supported roughly 180 participants in increasing their credit scores by an average of 45 points. These results reflect our data-driven, scalable approach and proven ability to deliver measurable financial outcomes across diverse populations.

Guided by Boston’s collective impact model and the Community Builds Credit Planning Guide from the Credit Builders Alliance (CBA), NeDA applies culturally competent, community-centered strategies tailored to the unique needs of the Twin Cities. With a 100% BIPOC staff and dual capacity as a nonprofit and certified CDFI through our lending arm, Centro de Finanzas, we provide both education and equitable financial products—ensuring participants can translate improved credit into long-term stability and homeownership.

NeDA’s leadership, expertise, and community-rooted approach make us uniquely positioned to drive systemic change, advance racial equity, and expand financial opportunity across the region as a sustained, city-wide effort.

Funding provided by

This initiative is made possible through the generous support of Wells Fargo.

Partnering for Credit Equity

Credit Builders Alliance (CBA) serves as a trusted bridge between equity-focused nonprofits and the credit industry, advancing systems-level change to ensure credit functions as an asset—rather than a barrier—for all communities.

Lending Opportunities at a Glance

NeDA combines one-on-one financial coaching with group workshops on credit building, budgeting, debt reduction, and homeownership readiness. Grounded in trust and cultural understanding, we help families set—and achieve—realistic financial goals.

In 2024, NeDA supported 1,300+ households, driving measurable improvements in credit, savings, and debt management. Through fair financial products, small-dollar loans, and down payment assistance paired with coaching, we remove barriers to credit and homeownership and help families build long-term financial stability across the Twin Cities.

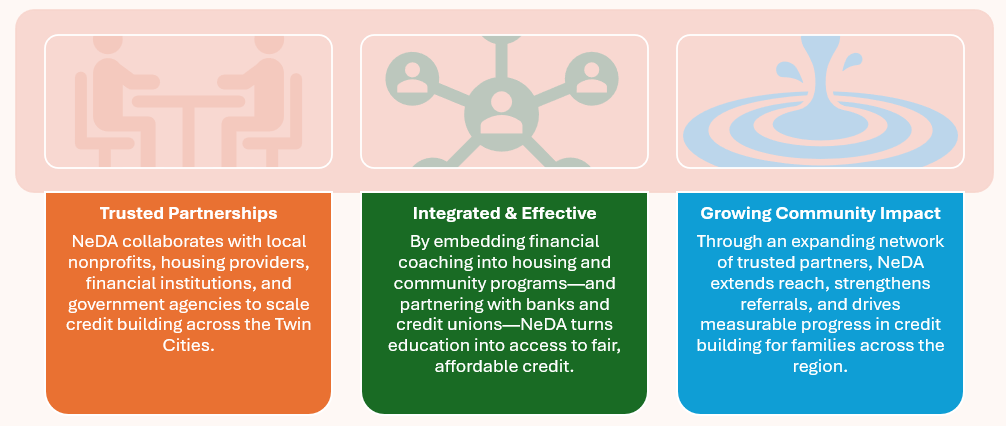

Partnerships

Take Your Next Step with NeDA

Build Credit. Build Confidence. Build Your Future.

© Samrawit Z. Bekele, University of St. Thomas

📧 info@nedahome.org 📞 651-292-0131 🌐 www.nedahome.org